Balance is the key in life. You need to find the right amount of equilibrium to manage your spending, saving and investing to fit your goals and your lifestyle. Interestingly enough, a good portion of the American population does not manage their money properly, compared to other developed countries.

However, some good tried-and-tested strategies can help you to have A sound management plan that could be the silver lining to get your finances in order.

Listed below are 5 ways to options for managing your funds

1. Create a Budget

Having a budget is quite necessary. But even more important is sticking to it, which is relatively tougher at first but pays off in the long run . It paints a clear view of your financial situation and this is the first step in understanding money.

This will bring balance to your finances and help save some cash for reserve/emergency fund (whichever you like). Digital financial options are making it easier to reach this point, f if you have some savings they can help you plan and track your earnings enabling you to manage your budget with ease.

2. Slash Unnecessary Expenses

Getting a coffee in your favourite place might be in your daily routine, yet have you ever wonder how much money are you spending? Multiply those lattes you buy in a year and you will probably come to $1,400.

Every penny counts and once you start tracking your expenditures it will get easier to know where you can cut a little bit. Nowadays there are great apps that can help you with this.

3. Understand the Expenses

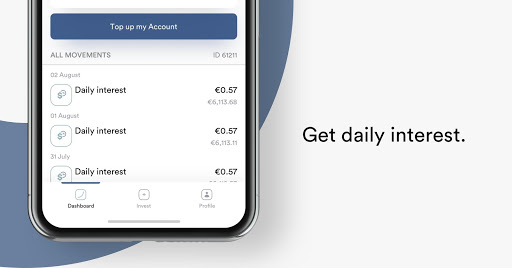

Ask someone about their monthly expenditures and they may not be able to do so effectively. This is hardly original. People do not know their expenses in any particular month. List down every single expenditure each month and take your bank statement. Everything will fall into place. This way, you can cut some recurring expenses and invest them to reap a profit on your investments. Try digital accounts, you can be surprised by the good conditions you can get through these platforms, at this point I want to mention Iban Wallet, which without fees and no minimum investment amount will give you interesting rates paid on a daily basis so you can see your savings growing everyday.

4. Save 10 to 15 percent as Reserve Fund

Yes, large expenses always come up when you least expect them and this is why an emergency fund is so important and if you put it in the right place, it will even get you a little win. With Iban wallet for example, you have the option to choose between 4 different accounts with specific conditions. This investment app, allows a person to invest a chunk of savings and earn daily interest on it. It has a brilliant model, which works for customers using it for financial returns. Their accounts offers a projected interest rate of 2.5% to 6%. You can start an account with just $1.  Final Verdict

Final Verdict

There is more to the list, which is beyond the scope of this piece. But for those who wish to set up a reserve fund and watch their money grow, Iban Wallet is good as a starting point. While you focus on your life, your money will work for you.