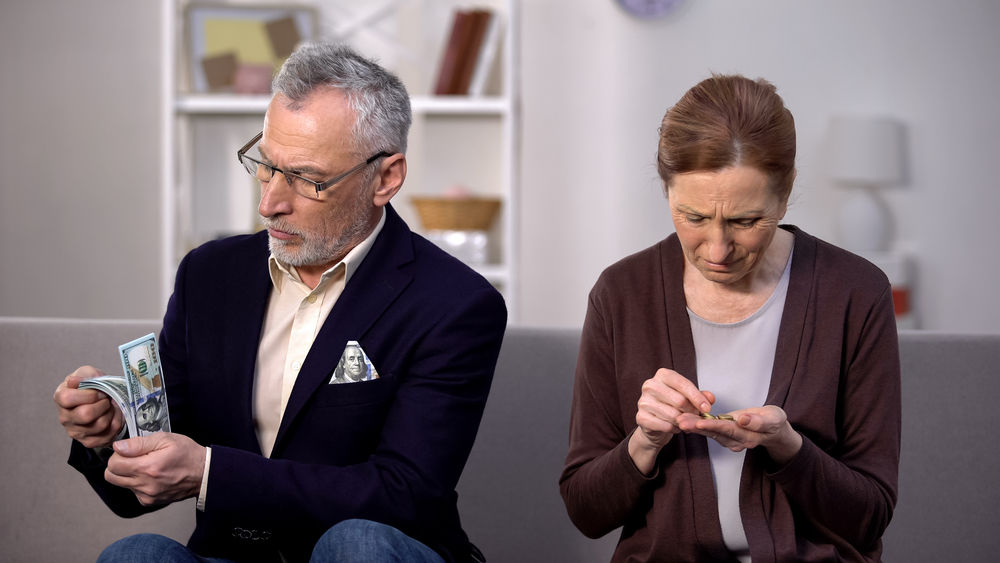

In the past decades, earning even a low six-figure salary meant you were rich on your way to getting there. But, in the past decade, people learned that a $100K dream salary means living paycheck to paycheck. Things have only worsened since the pandemic, with gloomy predictions that things will not get better.

$100K is not what it used to be

Many millennials grew up dreaming of earning $100K and above one day. But due to the inflation rate of -0.72% per year, $100,000 in 1990 is equivalent to over $230K in today’s world. Compared to 1995, it is nearly $205K. Though it appears that last year’s inflation came out of nowhere, it actually took us decades to reach this point.

Decline in standard

FEE reported that since 1933, the U.S. dollar has lost 92 percent of its domestic purchasing power. In 2023, CNBC’s Financial Confidence Survey reported that over 70 percent of Americans feel financially stressed. But the situation is not better in other countries, which are experiencing similar, if not worse, declines in living standards. Not that it makes anything better.

Prices have gone up everywhere, from health care to gas, and wages cannot keep up with inflation.

Housing prices have gone up

Since 2000, home prices have grown 121% faster than the cost of general goods. The pandemic only worsened the situation, and the rise in home prices surpassed overall inflation by 168%. If you are a millennial, you know that buying a house is nothing but a dream. This comes as no surprise since home prices have risen 1608% since 1970, while inflation has grown 644%.

The pandemic only made things worse

The economic growth from 2009 to the beginning of the pandemic shows that home prices grew by approximately $10,000 per year. Since the pandemic, a war in Europe and another in the Middle East, things have only worsened, and your paycheck can barely keep up with the prices. Some experts predict that housing prices will decelerate to accommodate income growth, but others are not so optimistic.

$100K is not the same depending on your location

Depending on your state of residence, those $100K look widely different. According to SmartAsset research, New York, San Francisco, and Honolulu are the most expensive cities in the States. Texas cities, El Paso, Corpus Christi, Lubbock, Houston, San Antonio, Fort Worth, and Arlington, are rated as the most affordable.

Most expensive living places in the US

Just how vast is the difference? If you live in NYC and earn $100K, you have nearly the same quality of life as someone making $36,000 annually almost anywhere else in the nation.

The situation in California is also following this worrying trend from New York. Around four in 10 households make over $100K, but house pricing now qualifies you for federal assistance in San Francisco and the Bay Area. Apart from San Francisco, the priciest cities in California are Los Angeles, Long Beach, San Diego, and Oakland.

The cost of student debt

Most high-paying jobs require the highest education, which comes with a price. According to the Federal Reserve of St. Louis, Americans owe $1.7 trillion in student loans. The biggest issue is that it’s double the amount owed a decade ago.

On average, a person owes $37,338 in student debt, which does not sound bad when earning $ 100K. Wrong. People live from paycheck to paycheck, and saving is only an option if you can live a frugal lifestyle. If you have kids, that debt will continue to grow until further notice.

The good news is that President Biden’s administration is working on a new student loan aid package. But not everyone is eligible, and the President’s previous attempts to cancel student debts failed.

The cost of having children

Earning $100K while caring for two children is a challenge. One child will cost you around $26K yearly, only to pay for necessities like education, daycare, and housing. But that also depends on your location, so some parents have to pay more than $36K yearly, which is why some opt out of staying at home instead of paying for daycare because it is cheaper.

The most and least expensive places to raise kids

The most expensive places to raise children, according to Care.com’s survey, are Washington DC, Massachusetts, Connecticut, and California. In contrast, Alabama, Louisiana, and West Virginia are the most affordable in the States.

$100K is still way above the average

All of the costs were calculated until your child was ready for college or until they turned 17. The question is, will your student loans be paid out by the time your child starts college? On the bright side, according to the U.S. Bureau of Labor, the average U.S. annual salary in 2023 was nearly $60K. So, if you are earning $100K, you are among the luckier ones.

Check out Care’s report here.