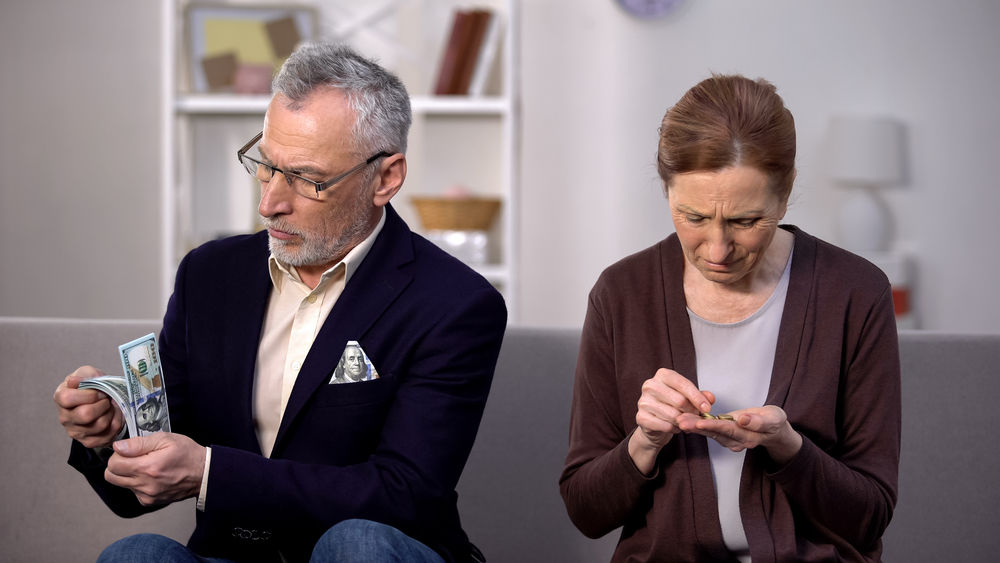

As inflation bites and prices continue to rise, everyone is looking to save money on the things they purchase. This has caused many to seek out advice on how to create frugal habits that will continue to save them money over time. There are many resources out there providing this type of advice, but some of the advice found doesn’t really save you much money at all in the long run. Here are some frugal habits that have been popular with the public, but could end up costing you more than you save.

As inflation bites and prices continue to rise, everyone is looking to save money on the things they purchase. This has caused many to seek out advice on how to create frugal habits that will continue to save them money over time. There are many resources out there providing this type of advice, but some of the advice found doesn’t really save you much money at all in the long run. Here are some frugal habits that have been popular with the public, but could end up costing you more than you save.

Traveling Longer Distances For Lower Gas Prices

Gas price apps have been a benefit to travelers by pointing out what places on their route have the lowest gas prices. While this can be beneficial while traveling on a road trip or finding a place to gas up on your way home from work, many people are using the app to find where the gas prices are lowest in their city and travel there to fill up. Since most gas stations in the same city only have a gas price difference of a few cents, traveling farther to fill up could actually be costing you more than you save.

Shopping At Multiple Stores For The Discounts

While it is important to try to save as much as you can on your purchases, shopping at different stores in a short timeframe simply to score discounts may not save you much in the long run. In addition to the cost of driving or taking public transportation to multiple stores, you also have to consider the amount of time it takes you going from store to store instead of making one stop to get everything you need. You also have to remember that stores are designed to encourage impulse purchases, so you may end up spending more than you wanted to just to score deals on things you could probably do without.

Denying Yourself Little Luxuries

Yes, coffee from a coffee shop is more expensive than making your coffee at home, but if you only buy one on occasion, the additional cost doesn’t add up to too much each month. However, it is well known that people that tend to deny themselves little luxuries along the way end up overspending on things they don’t really need when they do allow themselves to indulge. Life is about living comfortably and well, which means have a delicious ice cream cone when the situation calls for it.

While there are many ways to save money in your daily life, you should focus on the ones that bring you the biggest benefits. Lowering your monthly housing and utility costs will be way more beneficial for your financial health than preventing yourself from spending money on a candy bar at a convenience store. Those larger savings will also help you start putting away money for retirement and for other needs that may arise. Evaluate your options and choose the ones that make the most sense financially.

Are there any frugal habits that you’ve tried that didn’t work the way you expected? Share your story with us in the comments below.

Understanding How Changing Your Habits Can Improve Your Life

Smart Money Habits To Share With Your Children

4 Bad Spending Habits You Need to Break Today

Toi Williams began her writing career in 2003 as a copywriter and editor and has authored hundreds of articles on numerous topics for a wide variety of companies. During her professional experience in the fields of Finance, Real Estate, and Law, she has obtained a broad understanding of these industries and brings this knowledge to her work as a writer.