One of the newest scams spreading across the country is the SIM swap scam, an innovative way for fraudsters to drain victims’ bank accounts. The growing prevalence of this scam has prompted many warnings to the public about how the scam works and what the public can do to protect themselves. If you have never heard of the SIM swap scam, also known as SIM splitting, SIM hijacking, or sim jacking, here is everything you need to know.

One of the newest scams spreading across the country is the SIM swap scam, an innovative way for fraudsters to drain victims’ bank accounts. The growing prevalence of this scam has prompted many warnings to the public about how the scam works and what the public can do to protect themselves. If you have never heard of the SIM swap scam, also known as SIM splitting, SIM hijacking, or sim jacking, here is everything you need to know.

How Does the Scam Work?

The SIM swap scam works by taking advantage of a flaw in the two-factor authentication and verification process, which often uses a person’s phone number as an identifying characteristic. Smartphones have a subscriber identity module (SIM) card inside that is a small card with a chip inside that carries identifying information about your phone. This information includes details that identify the user, mobile carrier, and country of the smartphone.

The scammer tricks the company holding your phone account into activating a new SIM card with your phone number attached to it. Once the new SIM card has been activated, the scammer can intercept any calls or texts going to that phone number. Once the scammer has access to this information, they can determine where you bank and attempt to access the account.

If two-factor authentication is enabled, the bank will send a message to the phone number associated with the account with a unique code to gain access. If the scammer has your account information and this code, they can do virtually anything they want with your bank account. Victims have found their financial accounts drained by transfers and, in one notable example, former Twitter CEO Jack Dorsey had scammers take control of his social media accounts and make inappropriate posts in his name.

Warning Signs of a SIM Swap Scam

Several warning signs could be red flags that you have become a victim of a SIM swap scam. Knowing these signs and acting quickly can help limit the damage the scammers can cause in your life. These warning signs include:

- An inability to make calls or send texts using your smartphone

- An inability to access social media and financial accounts with login credentials

- Receiving notifications of activities you didn’t perform

- Receiving transaction alerts for transactions you didn’t make

How To Protect Yourself

Fortunately, there are some things that you can do to help reduce your chances of becoming a victim of a SIM swap scam.

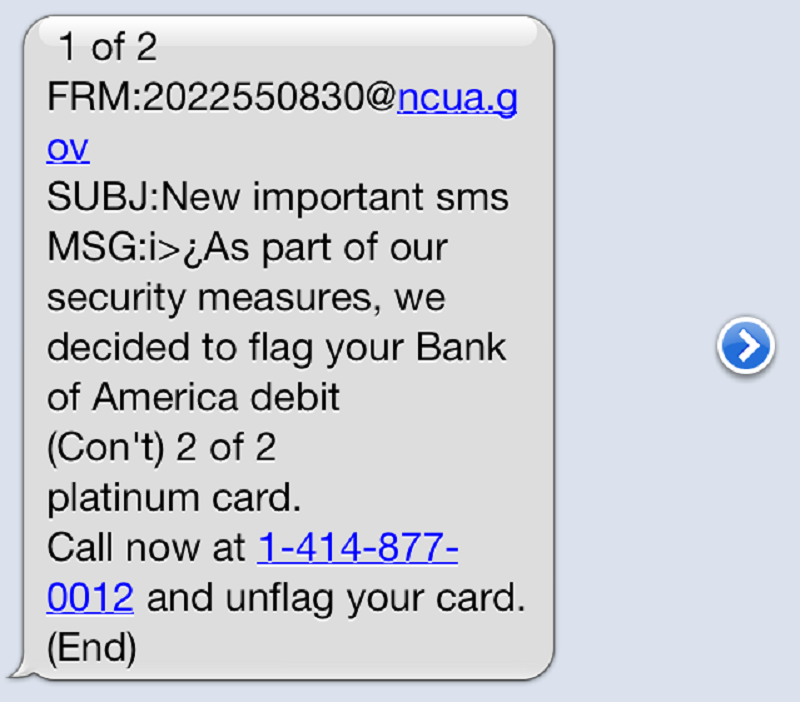

- Do not click on links in texts or emails from people you don’t know.

- Do not provide personal information through texts or emails.

- Use strong passwords and security questions to protect accounts.

- Do not post personal information that can answer security questions on social media accounts.

- Enable activity alerts on your accounts and pay attention when you receive them.

Do you have any tips for avoiding scams that you would like to share? Tell us in the comments below.

How To Deal With Text Messaging Scams

Don’t Fall for These 3 Types of Food Delivery Scams

Charity Fraud: Four Ways to Recognize Fake Donation Requests

Toi Williams began her writing career in 2003 as a copywriter and editor and has authored hundreds of articles on numerous topics for a wide variety of companies. During her professional experience in the fields of Finance, Real Estate, and Law, she has obtained a broad understanding of these industries and brings this knowledge to her work as a writer.