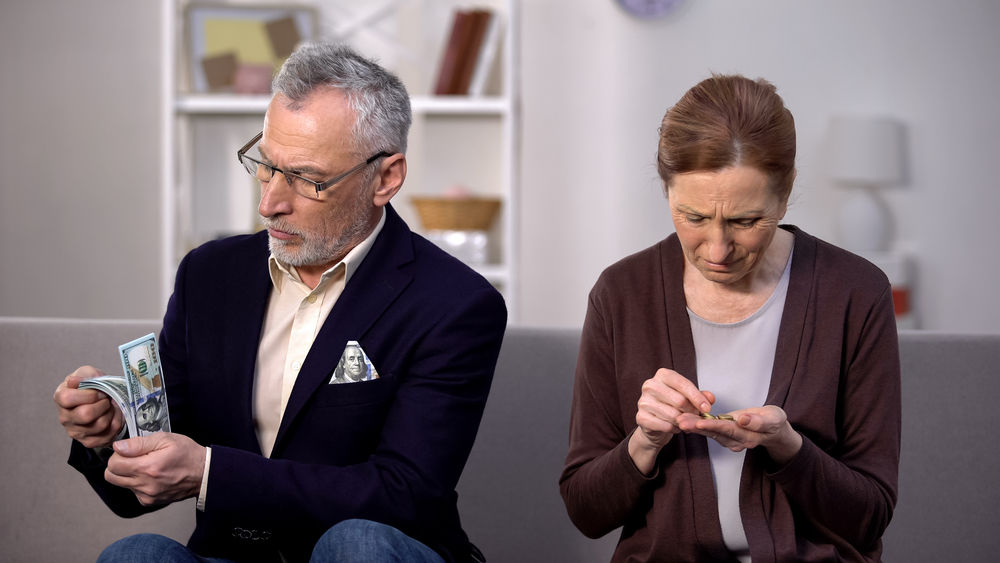

Getting into a car accident can be devastating on many levels. Not only can it be physically and emotionally traumatic, but it can also put a damper on finances. If your car is totaled or you suffer injuries, you may have many expenses to cover for a long time. Here are some ways that you can recover financially after a car accident.

Reduce Expenses

After you calm down after your accident, take a good look around and think about things that you can reduce or get rid of. For example, if you get your car back after repairs, there may be features you can do without. Car audio marketing was valued at $43 Million in 2018, which shows how much people love a good audio system while on the road. Maybe your audio system was damaged in the accident. Instead of replacing it with a new one, you can reduce costs by replacing it with used audio parts. When it comes to household expenses, you may want to cut back on things like movie streaming services, eating out, and unnecessary shopping until you’re financially comfortable again.

Contact Legal Help

One of the first things you should do is contact a local accident attorney. Almost 80% of those killed in crashes with large trucks were people in the other vehicle. If you survive a collision with a large truck or another car, a lawyer will help you get all the compensation due to you. An accident attorney understands how to pursue a case, deal with insurance companies, and handle any possible mediation. If you and the other party can’t come to a settlement during mediation, the attorney can represent you in a court trial.

Drive a Used Car

So what happens if your car is completely totaled? You may have to find alternative means to get around or reduce the type of car you had before. According to IBISWorld, there are 143,348 Used Car Dealers businesses in the US as of 2023. You have plenty of options for finding a suitable used car and you may even find one that looks new.

Use Car Insurance Wisely

Your car insurance is there to protect you in case of accidents. Whether your car was damaged or totaled, or you suffered injuries, insurance payouts are supposed to help cover those damages. As mentioned before, a local attorney will help you get the compensation you deserve. Once you get any insurance payouts, utilize those funds wisely. Instead of buying another new car, as mentioned, you can get a used car and save money. You can also use funds for physical therapy if injured. Look for free or cheap yoga lessons to help manage stress afterward.

Find Remote Work

There are many ways to make money without leaving the comfort of home. A car accident may have reduced or stopped your ability to work your previous job, and you need to find a way to earn income. If you’re still recovering or have to switch careers, you can find remote work online. Virtual assistant work, medical dictation, or online tutoring are just a few options you can consider.

A car accident can impact your life in many ways. While you recover financially and physically, there are many ways to do so. Fast legal assistance can ensure you understand your rights and get the compensation you deserve. Reduce your current expenses while utilizing the rise of remote work to help bring in more money. Getting into a car accident doesn’t have to be the end of your world. Take it a day at a time and utilize this guide to help improve your financial health.