We often read about how students and 20-somethings should budget their money while in college and after graduation, but what about the older millennials who have careers? How should 30-somethings spend and save their money with every paycheck.

We often read about how students and 20-somethings should budget their money while in college and after graduation, but what about the older millennials who have careers? How should 30-somethings spend and save their money with every paycheck.

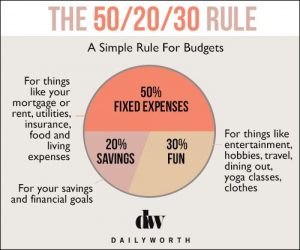

As a Financial Planner I can tell you that there’s not a right answer for everyone because there are always exceptions to the rule. However I do like to tell clients that the 50/30/20 rule is a good place to start setting a budget. From there you can adjust your spending and savings accordingly depending on your lifestyle.

What is the 50/30/20 budget rule?

Popular personal finance website LearnVest says that 50% of your after tax income should be spent on fixed living expenses such as rent, utilities, personal expenses such as your monthly cell phone bill and transportation costs. Basically all the constant expenses you need to live every month should make up 50% of your monthly spending.

The next biggest chunk of your budget should be spent on YOU! Take 30% of your after tax income and spend it on yourself. This could include things like dinner out with friends, saving for vacations and wardrobe upgrades. This part of your budget is fun money; so take it, go out and have a good time.

The remainder 20% of your monthly budget should be saved. It’s up to each of us individually how we choose to allocate the money between retirement funds and cash savings for an emergency, but either way 20% of your monthly after tax income should be set aside.

What does that mean in terms of your money?

I always like to budget money with after tax income because if you use your gross salary to set expenses you could find yourself coming up short every month.

Glamour Magazine says that the average college grad in their 30s earns approximately $51,000 gross annual income. The after tax take home amount of money that goes into your pocket depends on the state or provincial tax rate.

How my spending adds up

The majority of my money is spent on living costs with groceries coming in second place to rent and savings coming in last after our fun money. The majority of my fun money is usually spent on eating out or buying miscellaneous things for the apartment. I walk to and from work and BF works from home so we don’t have any transportation costs.

Here’s my biweekly budget breakdown:

Total after tax income: $1900

67% is spent on living expenses including rent, groceries, cable, cell phones and hydro

6.5% is saved for retirement and outside

26.5% is leftover for fun money

I choose to spend extra money on rent because we live in a great neighborhood and we pay for it. I am definitely not saving as much of my pay check as I should, but with my employer investment matching plan and my annual bonus (fingers crossed) it all adds up come year end. My fun money is almost on target, but honestly we don’t even spend every dime of it.

What’s your biggest monthly expense?

Great advice. I think many people, and PF bloggers, often overlook the fact that financial needs and advice vary wildly depending on where people are in their lives. Someone starting off in their 20’s versus someone nearing retirement in their 60’s are going to have completely different goals and actions from one another. Spotlighting certain groups is very important.